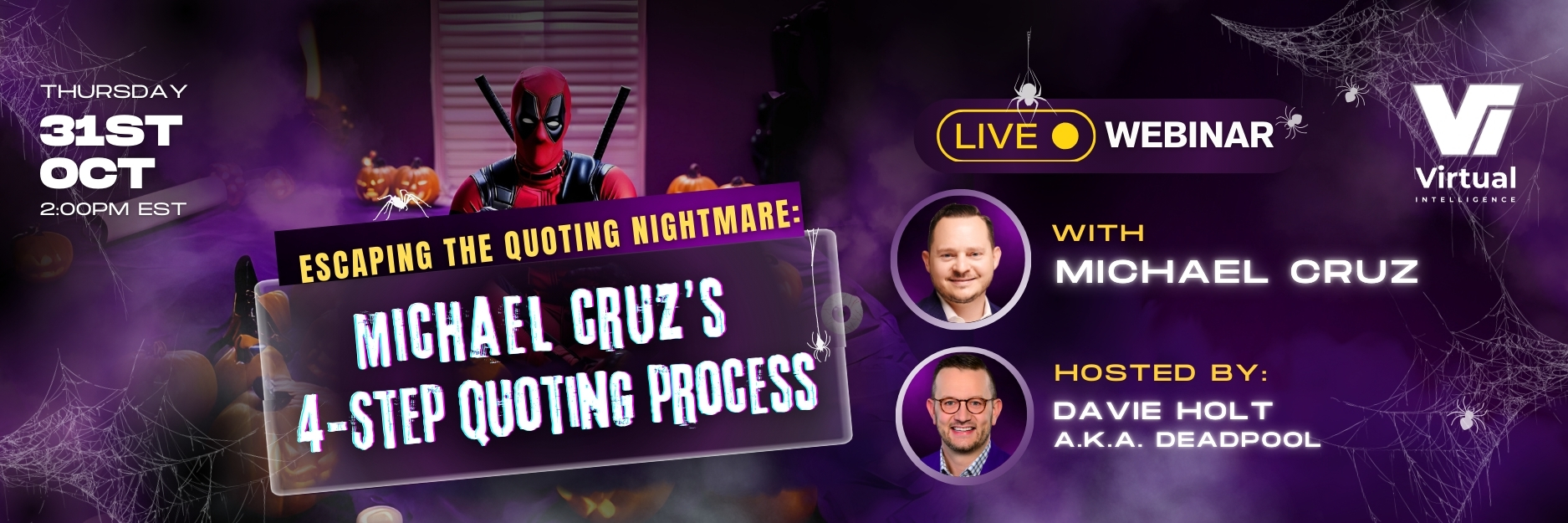

Escaping the Quoting Nightmare: Michael Cruz’s 4 Step Quoting Process – Webinar

In the fast-paced world of insurance, agencies often find themselves trapped in a quoting nightmare—wasting time on inefficiencies, struggling with inaccurate data, and losing potential clients due to delays. At Virtual Intelligence, we believe in leveraging technology and streamlined processes to eliminate these bottlenecks and help agencies scale effectively.

That’s why we’re excited to highlight Michael Cruz’s 4-Step Quoting Process, which he recently shared in a powerful webinar: Escaping the Quoting Nightmare. If you’re looking to transform your quoting process and increase efficiency, this is a must-watch. Here’s a breakdown of the key takeaways from Michael’s game-changing approach.

The 4-Step Quoting Process

Step 1: Data Intake and Accuracy

One of the biggest quoting pitfalls is starting with incomplete or incorrect data. Agencies waste valuable time going back and forth with clients to gather missing information. Michael emphasizes using RiskAdvisor and Gaya AI to streamline this step. These tools help ensure accurate and complete data collection from the start, reducing manual entry and errors.

Key Benefits:

- Automates data gathering

- Reduces the risk of inaccurate quotes

- Saves time by eliminating back-and-forth with clients

Step 2: Centralized Quoting Technology

Instead of juggling multiple carrier portals, Michael stresses the importance of using a centralized quoting platform like Gaya AI to submit applications efficiently. By leveraging automation, agencies can instantly compare multiple quotes and find the best fit for their clients.

Key Benefits:

- Faster quoting turnaround times

- Consistency across multiple carriers

- Eliminates the need for manual data entry in multiple systems

Step 3: Efficient Review and Comparison

With quotes in hand, the next step is to quickly analyze and compare coverage options. Many agencies get bogged down in manual reviews, but with RiskAdvisor’s AgencyProposals, agencies can generate side-by-side comparisons in seconds. This allows producers to focus on client needs rather than spending hours formatting proposals.

Key Benefits:

- Faster review process with automated comparisons

- Clear, professional proposals that boost client confidence

- Reduces time spent assembling multiple proposals

Step 4: Seamless Client Delivery and Follow-Up

The final step is ensuring that the quote is presented professionally and followed up effectively. Agencies using AgencyZoom integrated with AMS360 can automate follow-ups, track client engagement, and ensure nothing falls through the cracks. Timely follow-ups are the difference between closing the deal and losing it to a competitor.

Key Benefits:

- Automated client communication

- Real-time tracking of client engagement

- Increased close rates with timely follow-ups

The Future of Quoting is Here

Michael Cruz’s 4-Step Quoting Process isn’t just about making quoting faster—it’s about making it smarter. By integrating cutting-edge tools like RiskAdvisor, Gaya AI, and AgencyZoom, agencies can escape the quoting nightmare and scale their operations efficiently.

If your agency is still stuck in manual quoting or struggling with inefficiencies, it’s time to make a change. Watch the full webinar here: Escaping the Quoting Nightmare and discover how Virtual Intelligence can help your agency implement these best practices.

Optimize Your Agency’s Quoting Process Today

Virtual Intelligence specializes in helping insurance agencies integrate technology, automate processes, and improve efficiency. If you’re ready to take your quoting process to the next level, contact us today to learn how we can help.

SEO Optimized Keywords:

- Insurance quoting process

- Insurance agency automation

- Gaya AI insurance quoting

- RiskAdvisor AgencyProposals

- How to speed up insurance quotes

- Best insurance quoting tools

- AgencyZoom and AMS360 integration

- Insurance sales automation

- Streamlining insurance quoting

- How to increase insurance quote close rates

By implementing this streamlined approach, agencies can